Taxes & Utilities

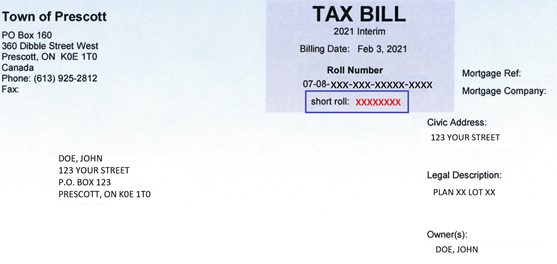

The Town of Prescott issues tax bills twice a year. The interim bill, issued in early February is based on 50% of the total taxes of the previous year. After Council approves the annual budget, tax rates are set and final tax bills are issued.

Interim tax bills are issued the first week in February and due the beginning of April in one installment.

Final tax bills are issued the first week of July and due at the end of August.

If you have not received your tax bill a week before the due date, please call the Finance Department.

The fee to obtain a Tax Certificate is $50.00. Please contact the Taxation Department if you require a certificate at 613-925-2812 ext. 6211

Taxation Information

How to Pay your Property Taxes

Did you know there are multiple ways you can pay your taxes?

1. Online Banking (add payee) - Set up “Town of Prescott” (this may display as "Prescott (Town) Taxes," "Prescott (Corp of Twn)-Taxes" or a similar form) as a payee with your online banking provider, using your "short" property roll number as your account number.

2. At your banking institution.

3. By mailing a cheque to: 360 Dibble Street West, P.O. Box 160, Prescott, ON K0E 1T0

4. In-person at the Municipal Office (Due to COVID-19 restrictions, this option may not be available, please call ahead 613-925-2812 x 6200.)

Please notify the tax office in writing if you have recently purchased a property or if your mailing address is changed. If you have sold your property, please forward the tax bill to the new owner or return it to the tax office. Failure to receive a tax bill will not invalidate penalty and interest charges.

Mortgage companies: Only ONE tax bill is issued per billing. If a mortgage company or agent pays the tax bill on your behalf, it is your responsibility to forward it to them. The Town mails receipts to the owner after payment by the mortgage company.

Late payment penalty: A penalty of 1.25% for late payment is added the day following the due date and the first day of each month thereafter.

Payment methods available: Payments will be received by mail or in person at the Town Hall, 360 Dibble St. West. Payment type accepted: cash, interac, cheque or money order. Payment by credit card is not accepted. Please bring the entire tax bill and your payment will be receipted. Payment can also be made in person at most financial institutions on or before the due date, subject to any applicable fees of the financial institution. Internet or telephone bank payments are accepted. Input the 8-digit tax account number on your tax bill.

For information on how the value of your property is assessed, you can find information at the Municipal Property Assessment Corporation website or call them at 1-866-296-6722.

Property owners may apply to adjust taxes to reflect a significant change in their property. Under certain conditions, Town Council has the authority to accept applications for cancellation, reduction or a refund of property taxes, as per Sections 357 and 358 of the Municipal Act RSO 2001, C 25. Examples of eligible criteria are:

- Repairs or renovations that prevent the normal use of the land for a minimum of 3 months.

- Tax classification changes.

- Lands that have become Exempt

- Structures razed or damaged by fire or demolitions.

- Removal of a mobile home.

- If the property has become vacant land or excess land since the return of the last assessment roll.

- If the ratepayer has experienced sickness or extreme poverty they may apply to have their appeal heard by the Assessment Review Board.

- Gross or manifest errors.

Tax Adjustment Applications can be picked up at the Town Hall or can be completed by printing off the online form.

| Tax Class | Municipal | Education Rate | Total |

| Residential | 0.01610050 | 0.00153000 | 0.01763050 |

| New Multi-residential | 0.01771055 | 0.00153000 | 0.01924055 |

| Multi Residential | 0.02317297 | 0.00153000 | 0.02575734 |

| Commercial Occupied | 0.03049696 | 0.00880000 | 0.03929696 |

| Commercial Excess Land | 0.02134786 | 0.00880000 | 0.03014786 |

| Commercial Vacant Land | 0.02134786 | 0.00880000 | 0.03014786 |

| Industrial Occupied | 0.04234432 | 0.00880000 | 0.05114432 |

| Industrial Excess Land | 0.0275238 | 0.00880000 | 0.0363238 |

| Industrial Vacant Land | 0.0275238 | 0.00880000 | 0.0363238 |

| Pipelines | 0.02217329 | 0.00880000 | 0.03097329 |

| Farms | 0.00402513 | 0.00038250 | 0.00440763 |

| Managed Forests | 0.00402513 | 0.00038250 | 0.00440763 |

| Tax Class | Municipal | Education Rate | Total |

| Residential | 0.01539981 | 0.00153000 | 0.01692981 |

| New Multi-residential | 0.01693979 | 0.00153000 | 0.01846979 |

| Multi Residential | 0.02317297 | 0.00153000 | 0.02470297 |

| Commercial Occupied | 0.02916973 | 0.00880000 | 0.03796973 |

| Commercial Excess Land | 0.02041881 | 0.00880000 | 0.02921881 |

| Commercial Vacant Land | 0.02041881 | 0.00880000 | 0.02921881 |

| Industrial Occupied | 0.04050150 | 0.00880000 | 0.04930150 |

| Industrial Excess Land | 0.02632598 | 0.00880000 | 0.03512598 |

| Industrial Vacant Land | 0.02632598 | 0.00880000 | 0.03512598 |

| Pipelines | 0.02120831 | 0.00880000 | 0.03000831 |

| Farms | 0.00384995 | 0.00038250 | 0.00423245 |

| Managed Forests | 0.00384995 | 0.00038250 | 0.00423245 |

| Tax Class | Municipal | Education Rate | Total |

| Residential | 0.01469939 | 0.00153000 | 0.01622939 |

| New Multi-residential | 0.01616933 | 0.00153000 | 0.01769933 |

| Multi Residential | 0.02211901 | 0.00153000 | 0.02364901 |

| Commercial Occupied | 0.02784303 | 0.00880000 | 0.03664303 |

| Commercial Excess Land | 0.01949011 | 0.00880000 | 0.02829011 |

| Commercial Vacant Land | 0.01949011 | 0.00880000 | 0.02829011 |

| Industrial Occupied | 0.03865940 | 0.00880000 | 0.04745940 |

| Industrial Excess Land | 0.02512861 | 0.00880000 | 0.03392861 |

| Industrial Vacant Land | 0.02512861 | 0.00880000 | 0.03392861 |

| Pipelines | 0.02024371 | 0.00880000 | 0.02904371 |

| Farms | 0.00367485 | 0.00038250 | 0.00405735 |

| Managed Forests | 0.00367485 | 0.00038250 | 0.00405735 |

| Tax Class | Municipal | Education Rate | Total |

|

Residential |

0.01417765 |

0.00153000 |

0.01570765 |

|

New Multi-residential |

0.01559542 |

0.00153000 |

0.01712542 |

|

Multi Residential |

0.02133392 |

0.00153000 |

0.01712542 |

|

Commercial Occupied |

0.02685447 |

0.00880000 |

0.03565477 |

|

Commercial Excess Land |

0.01879833 |

0.00880000 |

0.02759833 |

|

Commercial Vacant Land |

0.01879833 |

0.00880000 |

0.02759833 |

|

Industrial Occupied |

0.03728722 |

0.00880000 |

0.04608722 |

|

Industrial Excess Land |

0.02423669 |

0.00880000 |

0.03303669 |

|

Industrial Vacant Land |

0.02423669 |

0.00880000 |

0.03303669 |

|

Pipelines |

0.01952518 |

0.00880000 |

0.02832518 |

|

Farm |

0.00354441 |

0.00038250 |

0.00392691 |

|

Managed Forests |

0.00354441 |

0.00038250 |

0.00392691 |

| Tax Class | Municipal | Education | Total |

| Residential | 0.01378478 | 0.00153000 | 0.01531478 |

| Multi-Residential | 0.02074274 | 0.00153000 | 0.02227274 |

| Commercial Occupied | 0.02611061 | 0.00880000 | 0.03491061 |

| Commercial Vacant/Excess Land | 0.01827742 | 0.00880000 | 0.02707742 |

| Industrial Occupied | 0.03625397 | 0.00880000 | 0.04505397 |

| Industrial Vacant/Excess Land | 0.02356508 | 0.00880000 | 0.03236508 |

| Pipelines | 0.01898412 | 0.00880000 | 0.02778412 |

| Farmlands | 0.00344620 | 0.00038250 | 0.00382870 |

| Managed Forests | 0.00344620 | 0.00038250 | 0.00382870 |

| Multi-Res New Construction | |||

| Commercial New Construction | |||

| Industrial New Construction |

| Tax Class | Municipal | Education | Total |

| Residential | 0.01361460 | 0.00153000 | 0.01514460 |

| Multi-Residential | 0.02048666 | 0.00153000 | 0.02201666 |

| Commercial Occupied | 0.02578826 | 0.01250000 | 0.03828826 |

| Commercial Vacant/Excess Land | 0.01805178 | 0.01250000 | 0.03055178 |

| Industrial Occupied | 0.03580640 | 0.01250000 | 0.04830640 |

| Industrial Vacant/Excess Land | 0.02327416 | 0.01250000 | 0.03577416 |

| Pipelines | 0.01874975 | 0.00980000 | 0.02854975 |

| Farmlands | 0.00340365 | 0.00038250 | 0.00378615 |

| Managed Forests | 0.00340365 | 0.00038250 | 0.00378615 |

| Multi-Res New Construction | 0.01497606 | 0.00153000 | 0.01650606 |

| Commercial New Construction | 0.02578826 | 0.00980000 | 0.03558826 |

| Industrial New Construction | 0.03580640 | 0.00980000 | 0.04560640 |

| Tax Class | Municipal | Education | Total |

| Residential | 0.01334041 | 0.00161000 | 0.01495041 |

| Multi-Residential | 0.02085325 | 0.00161000 | 0.02246325 |

| Commercial Occupied | 0.02545584 | 0.01290000 | 0.03835584 |

| Commercial Excess Land | 0.01781909 | 0.01096500 | 0.02878409 |

| Commercial Vacant Land | 0.01781909 | 0.01096500 | 0.02878409 |

| Industrial Occupied | 0.03508528 | 0.01290000 | 0.04798528 |

| Industrial Excess Land | 0.02280543 | 0.01064250 | 0.03344793 |

| Industrial Vacant Land | 0.02280543 | 0.01064250 | 0.03344793 |

| Pipelines | 0.01859437 | 0.01030000 | 0.02889437 |

| Farmlands | 0.00333510 | 0.00040250 | 0.00373760 |

| Managed Forests | 0.00333510 | 0.00040250 | 0.00373760 |

Sale of Land by Public Tender

Public Works Department:

613-925-2812 X 6219 (daytime)

1-855-229-5764 (after hours)

Water & Sewer Department:

Have you recently moved? Your electricity and water distribution accounts must be setup through Rideau St. Lawrence Utilities. See Electricity Services drop-down.

613-925-2812 X 6219 (daytime)

1-855-229-5764 (after hours)

Optional Service Line Protection

Town of Prescott residents should expect to see mail correspondence from Service Line Warranties of Canada (SLWC). The information will include the Town of Prescott's name and logo, endorsing this third party optional service.

SLWC offers protection to homeowners for the water and sewer service lines that connect their homes to the municipal infrastructure. The SLWC program is recognized as a trusted source of utility line service plans by the Association of Municipalities of Ontario (AMO).

This program is voluntary and not a scam.

Enbridge Gas (formerly known as Union Gas) - Customer Inquiries

Smell Gas? Call Enbridge Gas immediately from outside your home or building at 1-866-763-5427 or 911.

The Town of Prescott's electricity services are distributed by:

Rideau St. Lawrence Distribution Inc.

985 Industrial Road

P.O. Box 699

Prescott, Ontario

K0E 1T0

After Hours Emergency: 1-866-276-1400

You can register for electronic billing for both electric and water accounts on the RSL My Utility Portal: https://rslu.myutility.net/portal/prod

Have you recently moved? Your electricity and water distribution accounts must be setup through Rideau St. Lawrence Utilities.

Bell Canada - Customer Service

1-800-668-6878

www.bell.ca

Cogeco - Customer Service

1-866-261-4447

www.cogeco.ca

Netfox

613-704-4317

www.netfox.ca

Xplore Inc.

1-877-605-3106

www.xplore.ca

Town of Prescott

Taxation Department

360 Dibble Street West

Prescott, ON

K0E 1T0

Phone: 613-925-2812 x 6211

Fax: 613-925-4381

Send an Email

Map this Location